The first chart shows all of these towns and their 2006 rate (green column) along with their "Constant Yield Rate" for 2007 (blue column) as calculated by the state. This, as I understand it, is the tax rate that would result in raising the same amount of revenue as last year's rate, given the increase in assessments that everyone has experienced.

The second chart leads to my first "Did you know?" question -- I was quite surprised by this fact. I took the "Constant Yield Rate" information from the state (Ward 1 representative-elect Alice Ewen Walker had posted the URL for this to TownTalk: http://www.dat.state.md.us

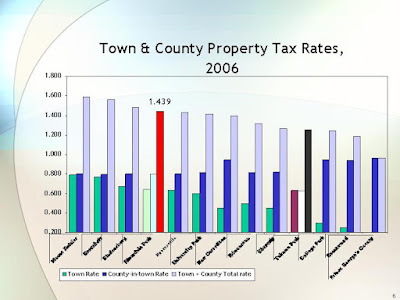

The second chart leads to my first "Did you know?" question -- I was quite surprised by this fact. I took the "Constant Yield Rate" information from the state (Ward 1 representative-elect Alice Ewen Walker had posted the URL for this to TownTalk: http://www.dat.state.md.us Something else that has me curious -- and I'd love to hear from everyone who knows anything about the whys and wherefores of all this -- is the rather dramatic variation in town tax rates vs the PG County tax rates in those towns. As I understand it, the more services a town provides, the greater the "discount" given by the county. So whereas PG Co. residents who don't live in any incorporated town or city pay a county rate of .960, here in Riverdale Park we only pay county taxes at a rate of .798, in recognition of the fact that PG Co. doesn't have to provide our police services or pick up our trash (among other things). In short, the higher we tax ourselves and provide services in the town, the lower our county rate. But I did notice two things, which can be seen in the third chart: One is that no town/city resident pays taxes as low as all the PG Co. residents who are not in any incorporated jurisdiction. In other words, no combination of town-plus-county rate comes close to being as low as the .960 rate that county residents pay. (PG Co. taxes are represented by the far-right column in the chart). This isn't particularly surprising, but is interesting nonetheless. More surprising to me is the wide variation in town rates: From Mt. Rainier's .790 down to Brentwood's .248! And although, as a result of the services it provides, Mt. Rainier pays a lower PG Co. rate than Brentwood, it's not *that* much lower (.803 vs .937). The chart shows, for each town, the town rate (left/green column), its county rate (middle/blue column), and finally the total of the two added together (right/gray column). (You can doubleclick on these graphs to see them in larger format)

Something else that has me curious -- and I'd love to hear from everyone who knows anything about the whys and wherefores of all this -- is the rather dramatic variation in town tax rates vs the PG County tax rates in those towns. As I understand it, the more services a town provides, the greater the "discount" given by the county. So whereas PG Co. residents who don't live in any incorporated town or city pay a county rate of .960, here in Riverdale Park we only pay county taxes at a rate of .798, in recognition of the fact that PG Co. doesn't have to provide our police services or pick up our trash (among other things). In short, the higher we tax ourselves and provide services in the town, the lower our county rate. But I did notice two things, which can be seen in the third chart: One is that no town/city resident pays taxes as low as all the PG Co. residents who are not in any incorporated jurisdiction. In other words, no combination of town-plus-county rate comes close to being as low as the .960 rate that county residents pay. (PG Co. taxes are represented by the far-right column in the chart). This isn't particularly surprising, but is interesting nonetheless. More surprising to me is the wide variation in town rates: From Mt. Rainier's .790 down to Brentwood's .248! And although, as a result of the services it provides, Mt. Rainier pays a lower PG Co. rate than Brentwood, it's not *that* much lower (.803 vs .937). The chart shows, for each town, the town rate (left/green column), its county rate (middle/blue column), and finally the total of the two added together (right/gray column). (You can doubleclick on these graphs to see them in larger format)You may notice I stuck Takoma Park in this graph as well, just for comparison's sake. (Montgomery Co. has so few incorporated jurisdictions, it's difficult to make comparisons.)

As you can see, RP still ranks 4th among these area towns: 4th in town tax rate, and 4th in total town+county tax rate. (These are the 2006 rates of course).

Towns are L-to-R: Mt. Rainier, Greenbelt, Bladensburg, Riverdale Park, Hyattsville, University Park, New Carrollton, Edmonston, Cheverly, Takoma Park, College Park, Brentwood, and PG County (not in town or city).

Let me also add that I know the Mayor and others have, in fact, addressed this question to some extent. But I feel that the case for a rate increase has not been made in a way that allows us to clearly evaluate the proposal. As I suggested at the town meeting on May 21st, I believe what is needed is a three-column format for the budget proposal:

Column 1: 2006 budget

Column 2: 2007 budget to provide the exact same level of services (taking into account step increases, increases in workman's comp and health care costs, increase in fuel prices, etc.)

Column 3: 2007 budget proposal complete with proposed additional (or reduced) services

With such a presentation, we would be in a position, I believe, to meaningfully debate what we want our town to do, and to provide, fully informed about the cost of each item.

Back to my question I asked above: Please understand, I'm asking this in the most literal sense. Why, given the spike in everyone's assessments and the 'windfall' increase in revenues that will thus flow to the town even if we keep the same rate as last year, is it necessary this year to raise our rates? I'm all in favor of improving our town. And I firmly believe that the quality of services and amenities are commensurate with taxes. We'd all love to have the best schools, beautiful and spacious parks and greenspaces, good roads with no potholes, wide sidewalks, well-stocked and staffed libraries and a whole host of other public services -- and no taxes. But of course it just isn't possible. So we all do or at least should expect to pay taxes in order to maintain our town and state and nation as the kind of places we are happy and proud to live in.

I hope everyone will chime in. I look forward to meaningful discussion of these issues on line as well as at town meetings.

5 comments:

WOW! and thanks! Great Analysis Dwight!

Thanks, Brian. I'd love to hear your thoughts too.

You ask why the taxes are going up. The answer is: road improvements.

For many, many years the town has been putting off road improvements,

repairing them only when they were literally decaying into rubble.

Last year, the council and mayor decided to take advantage of low

interest rates, and got a loan to pay for doing many repairs at once.

It costs money, and it's why our taxes are going up.

It was touched upon at the budget meeting, but I'd also be interested if a study has been done projecting what the tax base would look like in the coming years with the addition of the commercial developments that are slated. I know it is taboo for politicians to predict the future, but it might be comforting if the possibility is that the tax rate may go down in the future. Though given the councils previous experience with reducing taxes, that may never happen again. Also, we've got to make it conducive for business to loacate to RP and high taxes aren't the way to do that.

Dwight,

Thank you for the excellent comparatives. It really puts a perspective on things. I too spoke at the public budget hearing about providing us with what a flat line spending plan would provide us and I think it would be a much needed basis upon which to compare.

Yes, roads are very important. And I understand the concept of taking advantage of lower interest rates to get the biggest bang for our buck. But so far, I see roads being repaired that weren't in such a state of disrepair to begin with. If that's the only reason why our taxes are increasing then we need to look carefully at that. It is my understanding that there are some expected increases in revenue with the new office buildings (NOAA, Wachovia, etc.,) coming on line and I would like to see those roads repaved when we have more commercial taxdollars in our coffers instead of middle class families footing the bill. Of course, if other cost savings are found in other line items that would be a help too.

I look forward to seeing everyone at Town Hall on Thursday evening with a thanks to Rob O for encouraging the council to set that date at last week's meeting. It kept the momentum going.

Post a Comment