I looked at the property tax rates set by some of our neighboring towns. Our 2006 rate of .641 was exceeded by Mt Rainier (.790), Greenbelt, and Bladensburg. Our rate exceeded those of Hyattsville (just under ours at .630), University Park, New Carrollton, Edmonston, Cheverly (.450), and finally, College Park (.299) and Brentwood (.248).

The first chart shows all of these towns and their 2006 rate (green column) along with their "Constant Yield Rate" for 2007 (blue column) as calculated by the state. This, as I understand it, is the tax rate that would result in raising the same amount of revenue as last year's rate, given the increase in assessments that everyone has experienced.

The second chart leads to my first "Did you know?" question -- I was quite surprised by this fact. I took the "Constant Yield Rate" information from the state (Ward 1 representative-elect Alice Ewen Walker had posted the URL for this to TownTalk:

http://www.dat.state.md.us/sdatweb/stats/cytr.htm ) and did a few calculations... Comparing the total "assessment base" for each of the towns in 2006 and 2007, it turns out that RP has the second greatest increase of all these towns in our area that I've listed. Mt. Rainier saw the greatest increase (18.7%) and we are right behind at 18.2%. Hyattsville and Brentwood follow next (17.8% and 16.6%, respectively) and the others are in a somewhat lower category ranging from New Carrollton's 12.9% down to University Park's 10.2%.

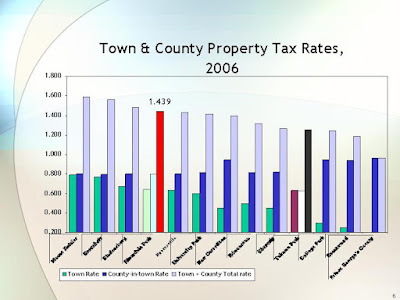

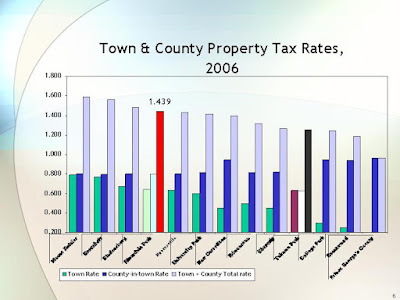

Something else that has me curious -- and I'd love to hear from everyone who knows anything about the whys and wherefores of all this -- is the rather dramatic variation in town tax rates vs the PG County tax rates in those towns. As I understand it, the more services a town provides, the greater the "discount" given by the county. So whereas PG Co. residents who don't live in any incorporated town or city pay a county rate of .960, here in Riverdale Park we only pay county taxes at a rate of .798, in recognition of the fact that PG Co. doesn't have to provide our police services or pick up our trash (among other things). In short, the higher we tax ourselves and provide services in the town, the lower our county rate. But I did notice two things, which can be seen in the third chart: One is that no town/city resident pays taxes as low as all the PG Co. residents who are not in any incorporated jurisdiction. In other words, no combination of town-plus-county rate comes close to being as low as the .960 rate that county residents pay. (PG Co. taxes are represented by the far-right column in the chart). This isn't particularly surprising, but is interesting nonetheless. More surprising to me is the wide variation in town rates: From Mt. Rainier's .790 down to Brentwood's .248! And although, as a result of the services it provides, Mt. Rainier pays a lower PG Co. rate than Brentwood, it's not *that* much lower (.803 vs .937). The chart shows, for each town, the town rate (left/green column), its county rate (middle/blue column), and finally the total of the two added together (right/gray column). (

You can doubleclick on these graphs to see them in larger format)You may notice I stuck Takoma Park in this graph as well, just for comparison's sake. (Montgomery Co. has so few incorporated jurisdictions, it's difficult to make comparisons.)

As you can see, RP still ranks 4th among these area towns: 4th in town tax rate, and 4th in total town+county tax rate. (These are the 2006 rates of course).

Towns are L-to-R: Mt. Rainier, Greenbelt, Bladensburg, Riverdale Park, Hyattsville, University Park, New Carrollton, Edmonston, Cheverly, Takoma Park, College Park, Brentwood, and PG County (not in town or city).

Towns are L-to-R: Mt. Rainier, Greenbelt, Bladensburg, Riverdale Park, Hyattsville, University Park, New Carrollton, Edmonston, Cheverly, Takoma Park, College Park, Brentwood, and PG County (not in town or city).

(Does anyone know about the other towns? A quick search at gazette.com didn't turn up any tax or budget news from any of our other neighbors).

Let me also add that I know the Mayor and others have, in fact, addressed this question to some extent. But I feel that the case for a rate increase has not been made in a way that allows us to clearly evaluate the proposal. As I suggested at the town meeting on May 21st, I believe what is needed is a three-column format for the budget proposal:

Column 1: 2006 budget

Column 2: 2007 budget to provide the exact same level of services (taking into account step increases, increases in workman's comp and health care costs, increase in fuel prices, etc.)

Column 3: 2007 budget proposal complete with proposed additional (or reduced) services

With such a presentation, we would be in a position, I believe, to meaningfully debate what we want our town to do, and to provide, fully informed about the cost of each item.

Back to my question I asked above: Please understand, I'm asking this in the most literal sense.

Why, given the spike in everyone's assessments and the 'windfall' increase in revenues that will thus flow to the town even if we keep the same rate as last year, is it necessary this year to raise our rates? I'm all in favor of improving our town. And I firmly believe that the quality of services and amenities are commensurate with taxes. We'd all love to have the best schools, beautiful and spacious parks and greenspaces, good roads with no potholes, wide sidewalks, well-stocked and staffed libraries and a whole host of other public services -- and no taxes. But of course it just isn't possible. So we all do or at least should expect to pay taxes in order to maintain our town and state and nation as the kind of places we are happy and proud to live in.

I hope everyone will chime in. I look forward to meaningful discussion of these issues on line as well as at town meetings.